Business Insurance in and around Asheboro

Researching insurance for your business? Search no further than State Farm agent Josh Murray!

Cover all the bases for your small business

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of challenges. You shouldn't have to work through those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, a surety or fidelity bond and extra liability coverage, among others.

Researching insurance for your business? Search no further than State Farm agent Josh Murray!

Cover all the bases for your small business

Cover Your Business Assets

Whether you own a pizza parlor, an art gallery or an arts and crafts store, State Farm is here to help. Aside from great service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

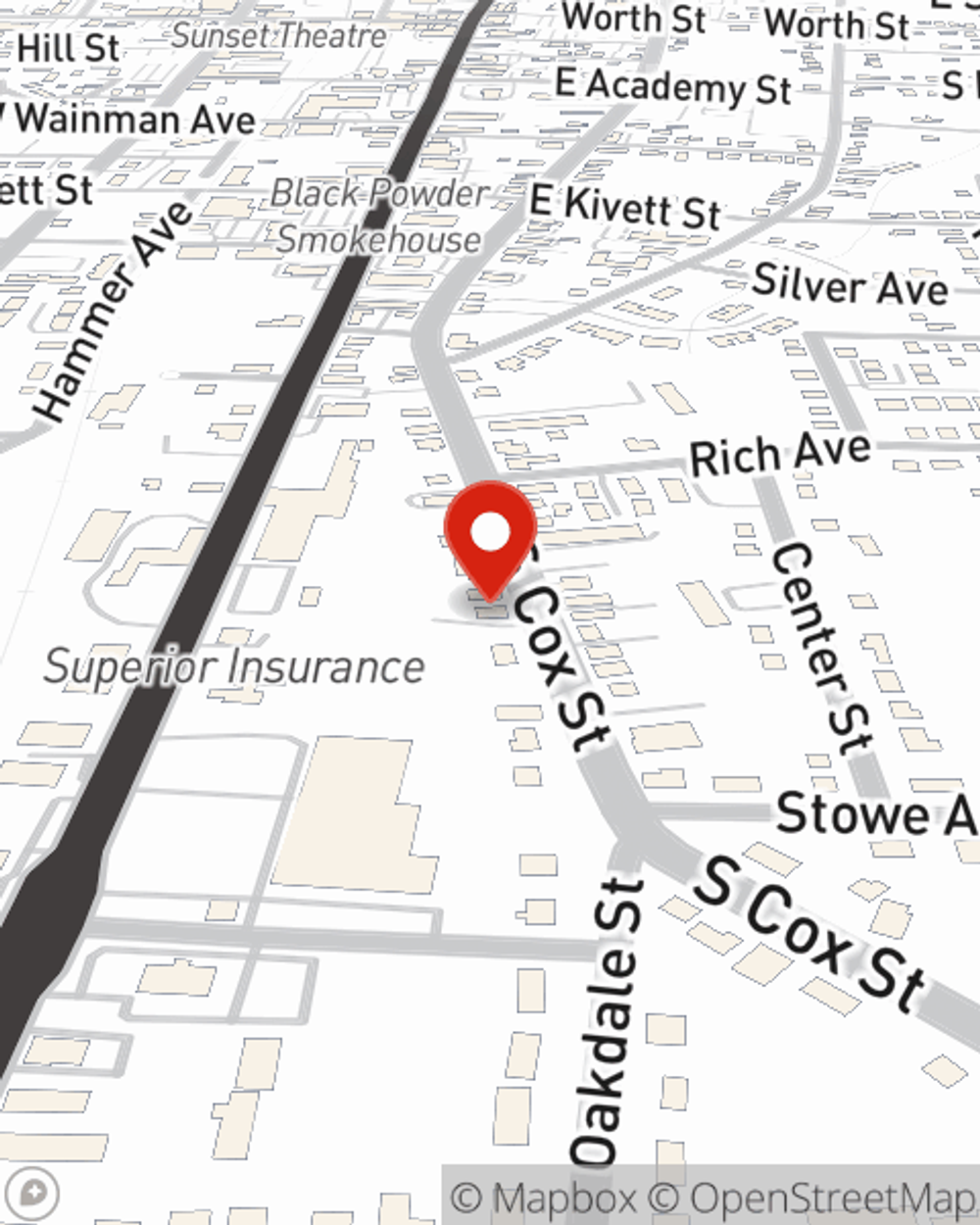

Agent Josh Murray is here to review your business insurance options with you. Reach out Josh Murray today!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Josh Murray

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.